|

World Conquest

April, 2009 | ||||||

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | ||

because ... well ... why not ...?

it's a dirty job, but somebody's got to do it.

- Thursday, April 30th

- 00:03AM

- 00:03AM

- Cut!

Just another day in the neighborhood...

April kicked off with the cameras starting to roll on the action/spy flick, Serpent Rising, followed immediately by the locations falling through for most of the first week of filming.

Which, I'm sure, fits somebody's idea of a fine April Fool's joke, but with most of the cast jetting in from LA or overseas, rescheduling would be a nightmare.

heck, figuring out the scheduling had *already* been quite nightmarish enough, and that was just to coordinate everybody's schedules and availabilities to begin with.

And so the crew of 45, the cast of umpty-ump, and a caravan of RVs and equipment trucks came rolling on down to a plateau southwest of Denver, Colorado, to shoot another movie here at the treehouse.

Oh, yeah, they *did* call first.

I'm glad the neighbors are used to this kind of thing. I bet in some more uptight neighborhoods, people can get a little weirded out when you stage a heavily-armed SWAT team assault on your house.

But we used a variety of exterior locations in and around the house and no small number of interior locations for various scenes of the movie.

Which was actually quite impressive--I have never seen a crew that managed camera moves and new setups as quickly as this group or with as little chaos and mess.

Which is a good thing, because there's always more than enough chaos and mess to go around already.

So the first half of April was a little more exciting than I'd planned for, which is great for a lot of things, but sleeping was not one of them, since there was usually enough to do through the night to get props and sets ready by the next morning when it would all begin again.

(and, considering my bad habit of doing things at the last minute (or, in this case, in the last month), it's probably no surprise that what I *had* planned for was to be spending that time doing taxes)

This year was a personal record for me tax-wise. In between research and other credits, assorted lesser-known deductions, and the nightmarish FrankenTax Monster called the "income forecast method" of computing the depreciation schedule for certain types of intellectual property assets including equity positions in certain movie productions, when I file taxes, it usually creates cascades of tax consequences that spray both forwards and backwards in time, requiring the filing of amended returns for every year they touch.

So I don't just file a return for the prior calendar year with the IRS, I have to go back and re-file the past returns changed by that return.

...and if those past years contain factors that carry backwards or forwards into other years that have already been filed, and the amendment alters those factors, then *those* years must also be amended and refiled.

*Whew!* I have tax years that had already been amended four times--before this year. (Which means it's "five times" now.)

But, as I'd said, this year broke all my past tax-filing records. The ping-pong ball progress of tax adjustments bouncing forward and backwards between tax years hit a total of twelve past returns that needed to be revised and refiled.

Fun, fun. But, then, a lot of people like solving sudoku puzzles. This is kind of similar, just a whole lot bigger.

...and has substantial penalties if you ever make a mistake.

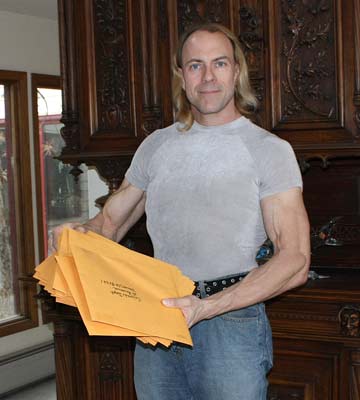

...now, at this point, the astute reader (assuming there are any left who haven't snoozed off by now) might have noticed that there is something a little bit amiss about my right arm in the picture above.

that's because it fell off.

Well, not *completely*, but let me tell you that it was still rather a shock to me.

I've had lots of fight scenes lately. Vigorous, intense fight scenes against multiple opponents, WWE pros, walls and bookcases (in all furniture-vs-me combat so far, the furniture *has* been defeated), fights with swords and knives, and the usual assortment of throwing and kicking and otherwise sending other stunt people flying through space.

But, in the end, what got me was plugging in a power cord. In my defense, let me say that it was a *three* prong power cord and was probably at least 16 gauge.

But, seriously, it wasn't in any way different from any of the other multitudes of power-cord-plugging events that fill my days...except for the loud (and disturbing) poppin noise from inside my arm and the outer side of my right bicep detached itself entirely from the bone and is now wandering around free under the skin of my upper arm.

(See it there, up on the top of the rest of the bicep muscle?)

Whereas, on my left arm, you can see the muscle still connects to something.

...which, let me tell you, has its advantages.

It's actually the result of a major pectoral tear (and associated shoulder damage) twenty-five years ago. It should have been fixed at the time, but when it happened, I managed to get a referral to an orthopedic surgeon who gave me the second-worst piece of medical advice that I have ever received in my life: "don't bother coming in; we wouldn't be able to diagnose it for at least a few weeks until after the swelling has gone down."

So I smooshed the pieces back together under the skin and held them in place with pillows for the next several weeks until I could get an appointment...at which point it was really too late to go in and do a better repair job than what I was able to do myself.

But it *did* hold for twenty-five years, which is better than most duct-tape repair jobs, I suspect.

Unfortunately, according to the MRI, the remaining ligaments and tendons of the shoulder are as much as 90% separated from the bone and are likely to tear the rest of the way off sometime in the next three months. Considering how rapidly things seem to be coming apart in there in just the last week, three months might be a little optimistic.

Even though it *does* give me new and different ways of grossing out strangers in public.

Six hours left to go, now. Another glass of water and I'm not supposed to eat or drink anything else until the surgery. Should take about two-and-a-half hours to reattach the tendons and ligaments to the bones, but they won't really know until they actually get in there because there's quite a bit of housekeeping to be done in there. We'll see how it goes.

|

Trygve.Com sitemap what's new FAQs diary images exercise singles humor recipes media weblist internet companies community video/mp3 comment contact |

|

|